If you think it’s too late to make money with an impact investment, you’d be mistaken. The truth is, we aren’t even out of the first inning. And if global trends are any indicator, the United States has the greatest potential upside when it comes to impact investing returns.

Recently, MIT released its Green Future Index, which ranks 76 leading countries and territories on their progress and commitment toward building a low carbon future. It ranks these countries on five pillars: Carbon emissions, Energy transition, Green society, Clean innovation, and Climate Policy.

You have to scroll down quite a ways to find the United States on this list. In fact, the U.S. finished 40th out of the 76 countries, lagging behind countries such as Mexico, India, and Brazil.

If this shocks you, it shouldn’t. The United States is responsible for 15% of global emissions and is struggling to move away from fossil fuels.

The good news is that the United States is positioning itself for tremendous growth in clean energy and green infrastructure. The new administration has committed to spending $2 trillion dollar over four years on a green infrastructure.

This means that the opportunity to create wealth through impact investing has never been greater. And if you think that impact investing couldn’t possibly realize the same returns as a traditional investment, well, you’d be mistaken here too.

Recently, Morgan Stanley put put out a study that asked the question, “Can you invest sustainably without sacrificing financial returns?” The research showed that from 2004 to 2019, there was no financial trade-off in the returns of Impact funds compared to traditional funds.

During this study, Morgan Stanly concluded that the total returns of sustainable funds and ETF’s were completely in-line with their traditional counter parts.

While this study was conducted over the past 15 years, we have seen an even greater ascension into sustainable funds in the past 2 years with Assets Under Management growing 42% from $12 trillion to $17 trillion. This trend leads us to believe that the returns from the top impact investing funds will soon outpace traditional funds.

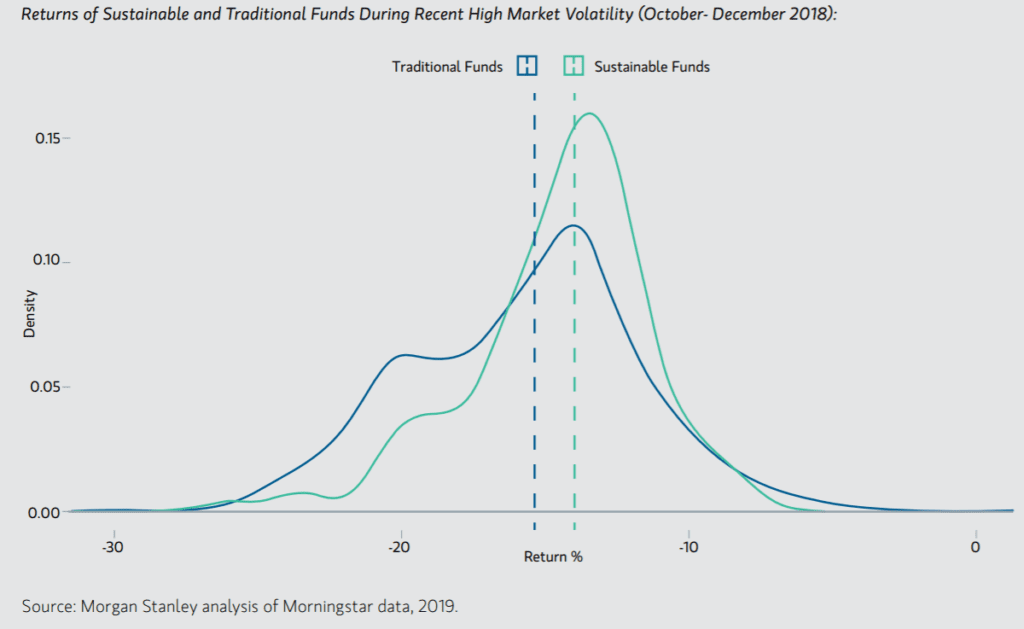

In addition, the social impact funds actually demonstrated lower downside risk during times of volatility.

Between a particularly volatile time in late 2018, sustainable funds outperformed the traditional funds by nearly 1.5%

You hear a lot about impact investing in the news recently. However, if you look closely, a lot of these headlines are “goal-oriented”. That means that countries and corporations alike aren’t claiming they’ve gone green but are rather putting clean energy goals on themselves to reach over the next several decades.

For example, the United States has created a goal of reducing its emissions by 28% by the year 2025.

Another example came from Ford last week when it announced plans to invest $1 billion in an electric vehicle production facility in Germany with the hopes of moving to “all-electric” passenger vehicles in Europe by 2030.

The world is going green and it’s these future-looking “announcements” that tell you we are still in the first inning of impact investing. It should also tell you that clean energy, EV, and Socially responsible stocks should see tremendous growth over the next several years and even decades as these goals become more of a reality.

To take make money off of these future trends with an impact investment, look for stocks that would support these goals.

For instance, recently, a Bank of America analyst said that Hydrogen is going to take 25% of all oil demand by 2050.

Hydrogen is an area that is gaining momentum. The EU announced plans to install 40 gigawatts of renewable hydrogen electrolyzers and produce as much as 10 million metric tons of renewable hydrogen by 2030.

A stock that could possibly be a leader in the hydrogen economy is Plug Power (PLUG). Plug Power is considered a “first mover” in the hydrogen energy sector.

Plug Power’s stock slid in February but were up over 1,000% in the past year. JP Morgan envisions Plug Power’s addressable market to expand beyond $200 billion and it expects meaningful profitability by 2023.

In Summary:

The trend is your friend. And while we are certainly in a green energy trend, we are still in the very early stages. Impact investing is an area that shows outstanding promise and could be a very profitable sector for years to come.