Using the power of the compounding dividend is a good way to build real wealth, simply.

When you buy a dividend paying stock, you normally receive a dividend every three months. When the dividend payment is received in your brokerage account you can either let the money sit there to eventually be spent on something, or you can automatically reinvest the dividends and buy additional shares of stock. Most times that additional stock will be just a fractional share.

The effects of compounding dividend reinvestment will be to increase the value of your portfolio more quickly.

The impact of the compounding dividends can be quite significant.

This is really a two-step process:

STEP #1 – Buy stocks of high-quality companies that pay a dividend. Use a criterion such as the one below to make sure the stocks you select are of the highest quality:

STEP #2 – Once you buy the stock in your brokerage account, change the setting so that the dividends are automatically investing in additional shares of stock when the dividends are paid. Most brokerage houses will do automatic dividend reinvestment at no cost.

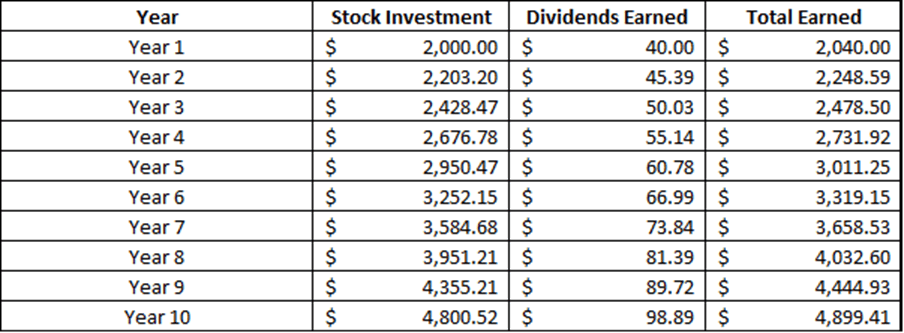

Once this two-step process is complete you will see the shares of stock for each of your businesses increase slowly as the dividends are reinvested to buy more shares at the market price at that time. It will look something like the following chart:

The chart assumes an 8% increase in the stock price each year which is in line with market averages. The chart also assumes a 3% increase in the dividend per share declared by the company, which is also in line with market averages.

But what is undeniable is that keeping more money in the stock market via dividend reinvestment has a compounding effect. The impact of the compounding dividend reinvestment combined with the increase in stock value creates an almost 4X increase in value over a ten-year period.

This is a great illustration of the compounding effect of dividend reinvestment. It can be used thinking of an investment in a dividend paying stock or fund.

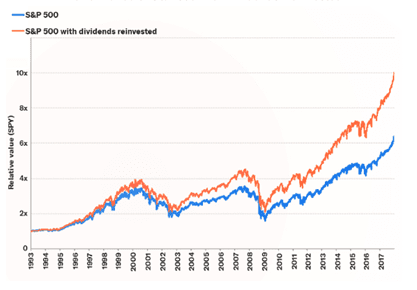

Historical S&P Index Returns With and Without Dividend Reinvestment

An even better example of the compounding effect of dividend reinvestment is to look at the impact on the total return of the S&P index over a long period of time.

As you can in the chart above, over the last 25-year period the difference in the total return for investing in the S&P index is the difference between a 6X return when you don’t reinvest dividends and a 10X return when you do reinvest dividends. That is incredibly significant.

Why Does Compounding of Dividends Make Such a Big Difference in Your Investing Returns

Albert Einstein is often given credit for saying “compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t pays it”

But compound interest has much older roots, tracing back to the Old Babylonia period (i.e., 2000-1600 BC), where they used the term “interest on interest”, which is effectively what compound interest is for investors.

“Interest on Interest” or “dividends on dividends” is in effect why the compounding effect on dividend reinvestment creates so much wealth. The longer you reinvest the dividends, the more dividends you receive because you own more shares. And the cycle continues as long as the investor stay invested in the market and reinvests his/her dividends.

With interest rates so low these days, people are drawn to high quality dividend growth stocks as an investment strategy. This works particularly well if the investor holds for long periods of time and reinvests the dividend into more shares of stock. The reinvested dividends will buy a few more shares when the price dips and a few less shares than the stock price is higher.

But the most important thing is for the investor to hold the high-quality stocks through the inevitable market volatility that will occur. When prices decrease during market volatility that is the best time to reinvest dividends, because when prices are lower you can buy more shares with your reinvested dividends.

Summary

The compounding effect of dividend reinvestment is a great way to build wealth, simply.

But be sure to pick high quality stocks that you will be safe accumulating over long periods of time.

Buy small amounts of additional shares over time by reinvesting the dividends paid by the business.

These additional shares will in turn increase the amount of dividends you receive.

And the cycle will continue for as long as you own those shares.