2020 was an incredible year for new investors. Many people started investing because there wasn’t much else to do during quarantine, the extra stimulus money they received, or headline-grabbing trends like GameStop and the Meme Stock phenomenon. Whatever the reason, 15% of total retail investors started investing in 2020. If you are new to investing, it is critical to ease your way in. Building a solid foundation of goals, education and investing style is a sure-fire way to make long-term gains. Another great way to start investing is to find the right investing app for beginners. One of the best on the market today is Acorns. Below we’ll show you exactly what makes Acorns a perfect fit for beginning investors with our 2021 Acorns App Review.

Acorns is a robo-advisor app created and designed for new investors who want to participate in the market but aren’t ready for a hands-on experience. Over 9 million investors are using Acorns today.

Founded in 2012, Acorns provides a unique approach to investing, allowing new investors to automatically invest spare change from everyday purchases like gas and groceries. The spare change is then invested into a diversified ETF (Exchange Traded Fund) that is created based on your goals and experience. Acorns also provides automatic portfolio rebalancing so dividends are automatically rebalanced for you

Acorns investing opportunities are purposefully limited. You can’t select individual stocks, and there are no opportunities to trade options. It is a very straight-forward investment app for beginners, allowing them to realize the power of compounding interest and provides an excellent foray into the stock market.

For those investors who are seeking more diversified options when it comes to investing apps, see our other reviews like:

Before choosing any investing app, we suggest using our Financial Independence Calculator. Our calculator, allows you to map your financial goals and optimize the path it takes to achieve them, all while improving your net worth and paying your debt as efficiently as possible.

Below, we take a closer look at Acorns with our Acorns App review, and why we feel this is the best investing app for beginners on the market today.

Acorns is an excellent investment app for beginning investors who want to participate in the stock market but are not ready for the hands-on management of a self-directed portfolio. They allow you to automatically invest “spare change” from your purchases, making recurring investments a breeze. Special Promotion: Sign up today and get $10

best for:

Beginning Investors, Robo-Advisor

Get Acorns Pros & ConsPros:

Cons:

At Wealthplicity, we rate and rank our investment apps based upon the most important criteria to the customer. We look to keep this criterion consistent across all reviews but may adjust upon industry or offerings.

As we mentioned, Acorns is best suited for new investors who want to participate in the stock market but are not ready for a hands-on, self-directed portfolio.

Acorns makes investing and staying invested a very simple and straight-forward process. In fact, out of all of the investment apps we tested here at Weatlhplicity, Acorns set-up was the easiest to understand and get started.

The “Invest Your Spare Change” is a revolutionary idea, and while it seems that $.50 cents here and there isn’t a lot of money, you’ll be surprised how quickly it adds up.

Another excellent feature that makes Acorns a great investing app for beginners is their Investment Education Feature. Acorns partners with CNBC to provide a wide range of financial literacy content.

Below, we dive into greater detail in our Acorn’s app review.

Acorns has a very straight forward fee structure that varies by the amount of features you want.

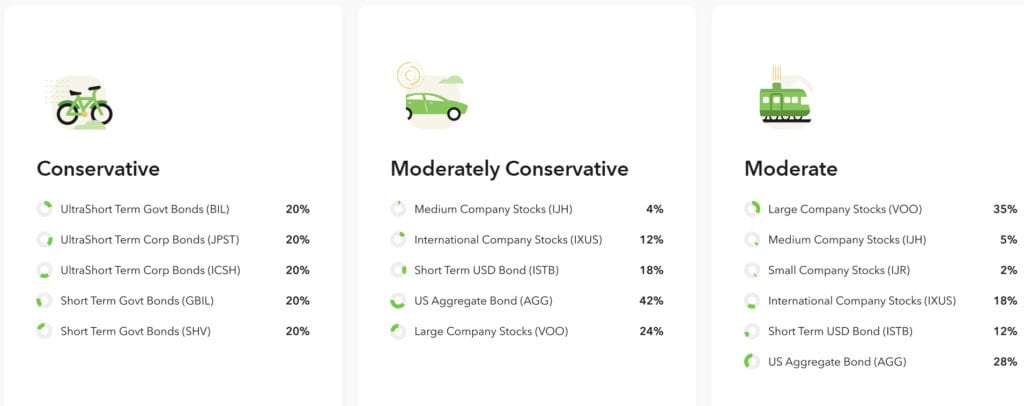

Acorns investment opportunities are intentionally limited. Acorns invests your money into Exchange Traded Funds or ETF’s. These are a diverse set of portfolios comprised of various holding, stocks and bonds.

Acorns has multiple ETF’s and you are assigned one based on your experience and goals.

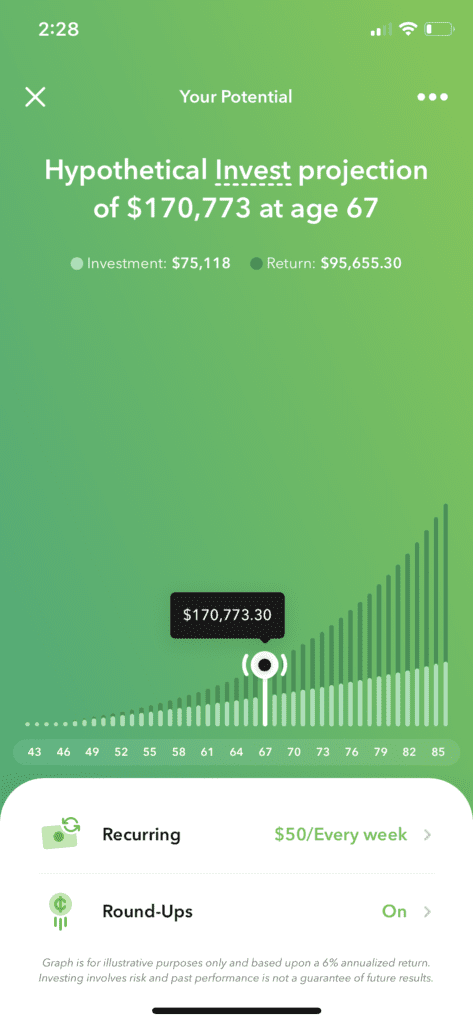

Perhaps the most exciting feature that Acorns offers is their “Invest Spare Change” feature. This allows you to “round up” spare change to the nearest dollar and automatically invest it in your portfolio. This is a great way to set recurring investments that adds up pretty quickly.

Acorns also offers a sustainable option which allows you to invest in funds that have been selected based on their environmental, social, and corporate governance standards or ESG.

Beyond personal investing, Acorns also provides access to checking accounts, investing for retirement, and setting investing accounts for your children.

Acorns does not have many investor requirements. You do not need to be an accredited investor and there is no account minimum to get started.

In fact, if you just want to set up the “Spare Change” feature, you can start investing with the spare change from your next run to the gas station.

Acorns has great usability, both on desktop and their mobile app. The simplicity of the app and user experience reflects the simplicity of the product. There are not a lot of bells and whistles which makes set up and making an initial deposit a breeze.

I did run into some initial technical difficulties where I kept on being logged-off in the middle of my session due to “inactivity” so that was a tad annoying. But this was on desktop and not my mobile app,

I do wish that they had better access to customer service. It took me a little longer to find the Chat feature to tell them about the log-in error and when I did there was a virtual agent. When I finally got to the actual Customer Support agent, I had to wait for 30 min with 6 people in front of me.

Acorns has a nice array of successful portfolios. I invested in the Moderately Aggressive, Core Portfolio. This portfolio has great diversification with a mixture of large cap, medium cap, small cap, international stocks and bonds.

Upon further examination, the ETF’s within this portfolio have performed very well over the past year. Investments in VOO (the large cap ETF) have returned nearly 60% this year. The medium and small cap ETF’s have also done very well, performing at 37% and 18% respectively.

Holdings in these ETF’s range from Apple, Microsoft and NVidia in the large cap ETF to Innovative Industrial Properties and Stamps.com in the small cap ETF. A review of these holdings shows that the holdings are great quality companies.

The bond ETF’s have been about flat. which is to be expected given the performance with stocks this year.

All in all, I am very pleased with this performance. It is great to see the diversification in these portfolios, as I tend to lean more domestically in stocks in my own portfolios.

There is always risk involved in any investment and past performance does not indicate future returns. But to see Acorn’s ETF’s performing above market, this year is a great sign that you could realize a significant positive return on your investment.

Summary:

During our Acorns app review, we found this app to be great app for beginners. Their invest “spare change” approach is revolutionary for those seeking to get started in the market. The usability and product offerings well-serve the overall intention of the app. Performance has been very solid and I fully recommend this service.